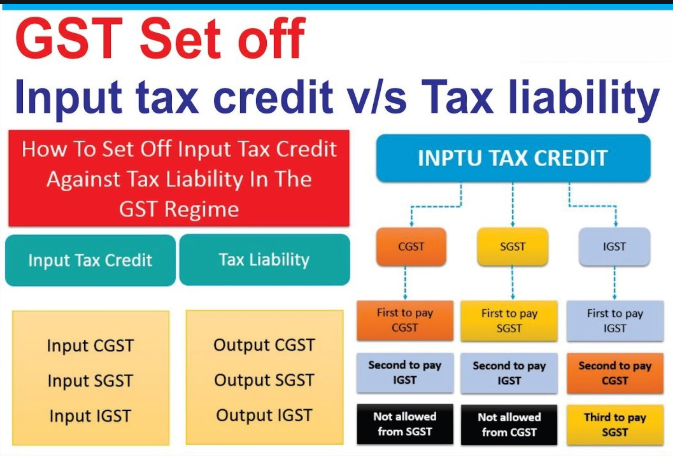

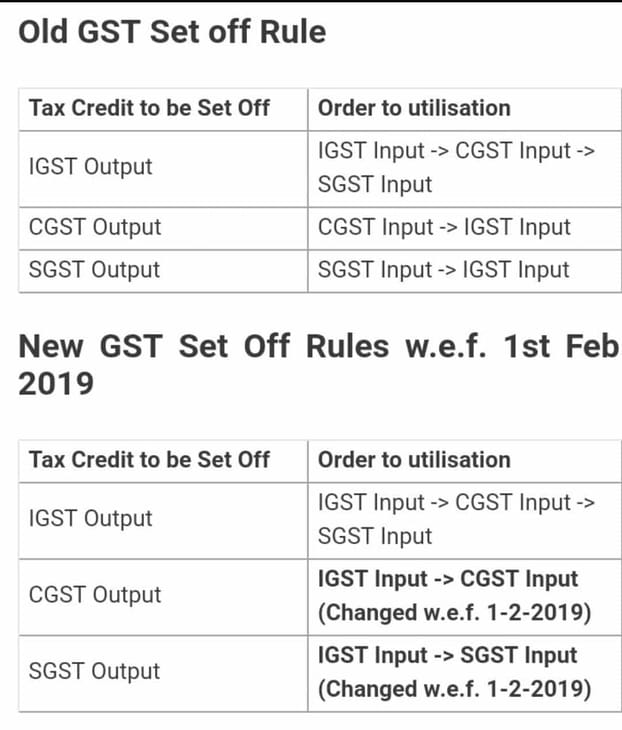

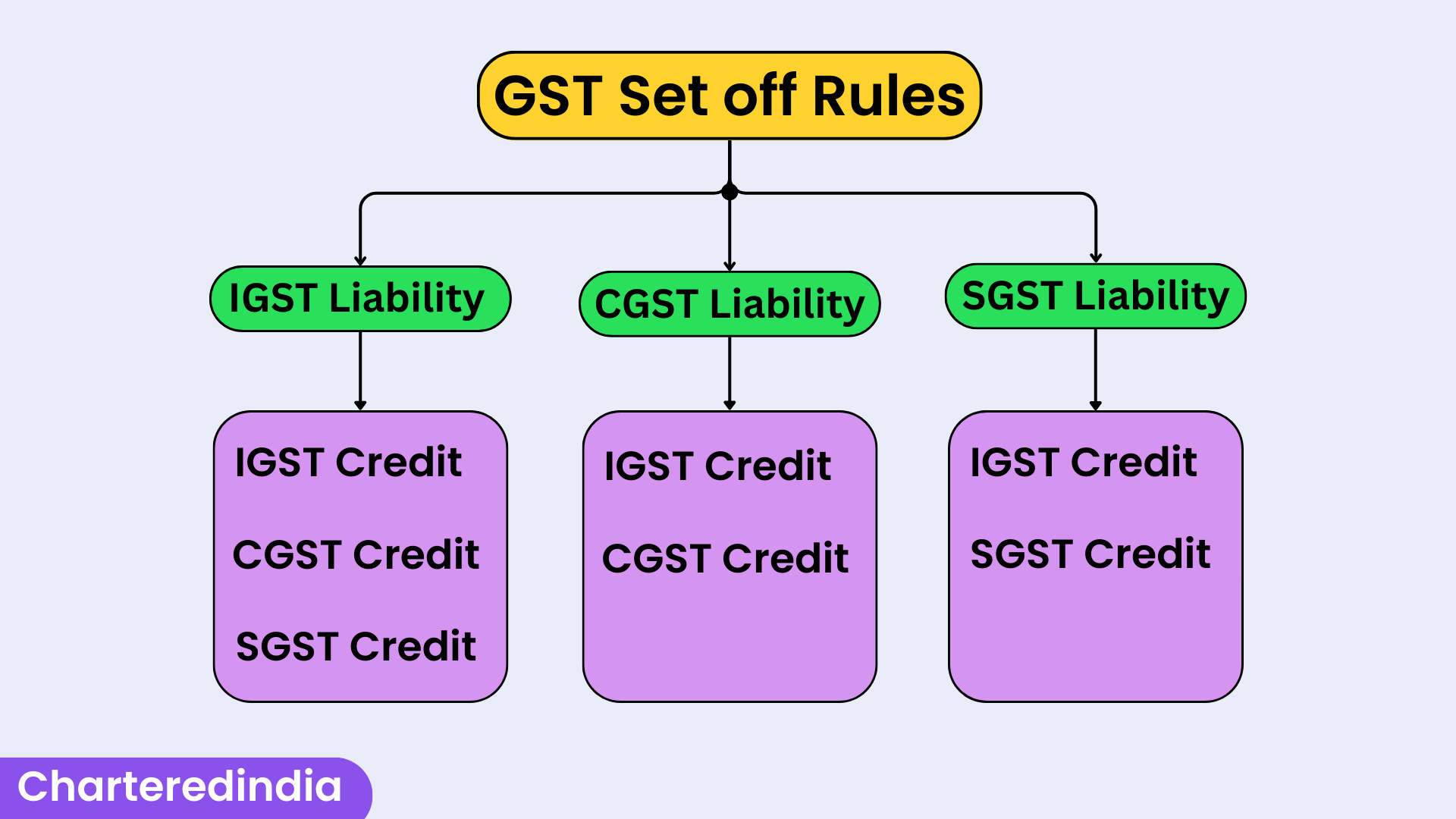

Taxread on X: "CBIC has recently clarified various issues on GST Input Tax Credit Set off Rules. Read full article on https://t.co/uvYXZkDiwT #taxes # gst #cbic #incometax #indirecttax #igst #cgst #utgst #sgst #business #

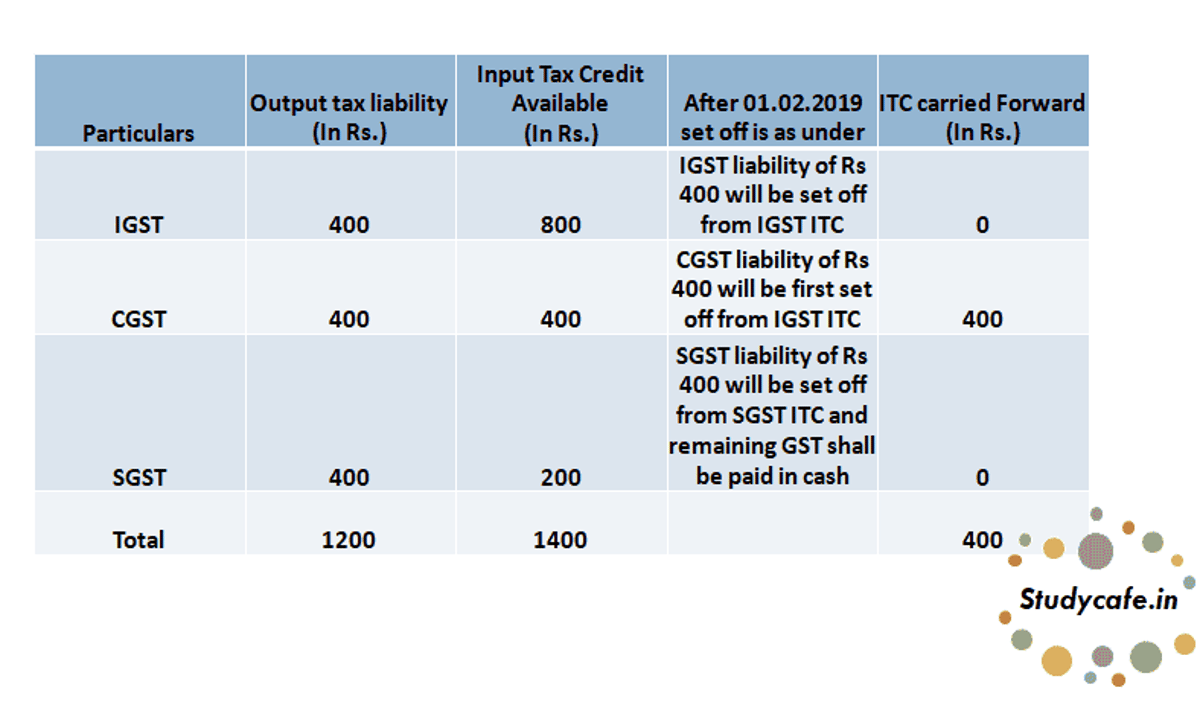

03 GST ITC Set Off Rules And Journal Entries | GST Payment Journal Entry | GST Refund Journal Entry - YouTube

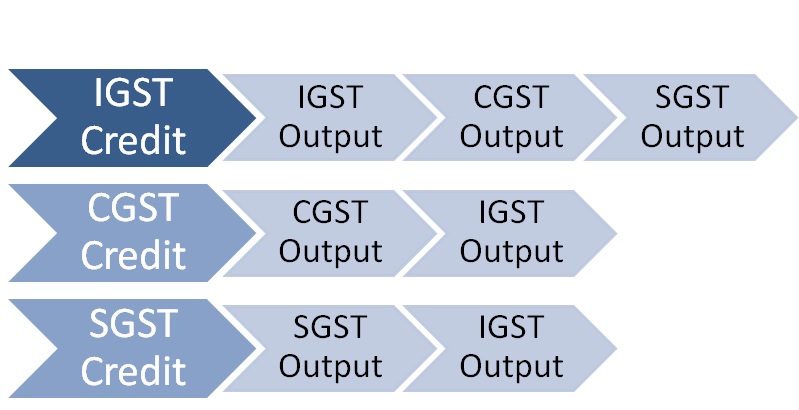

Goods and Service Tax (GST) Configuration (Tax Hierarchy and Set off Rules) in Microsoft Dynamics 365 Finance and Operations -Part-5 – Explore Microsoft Dynamics 365 Finance and Operations Together